<>

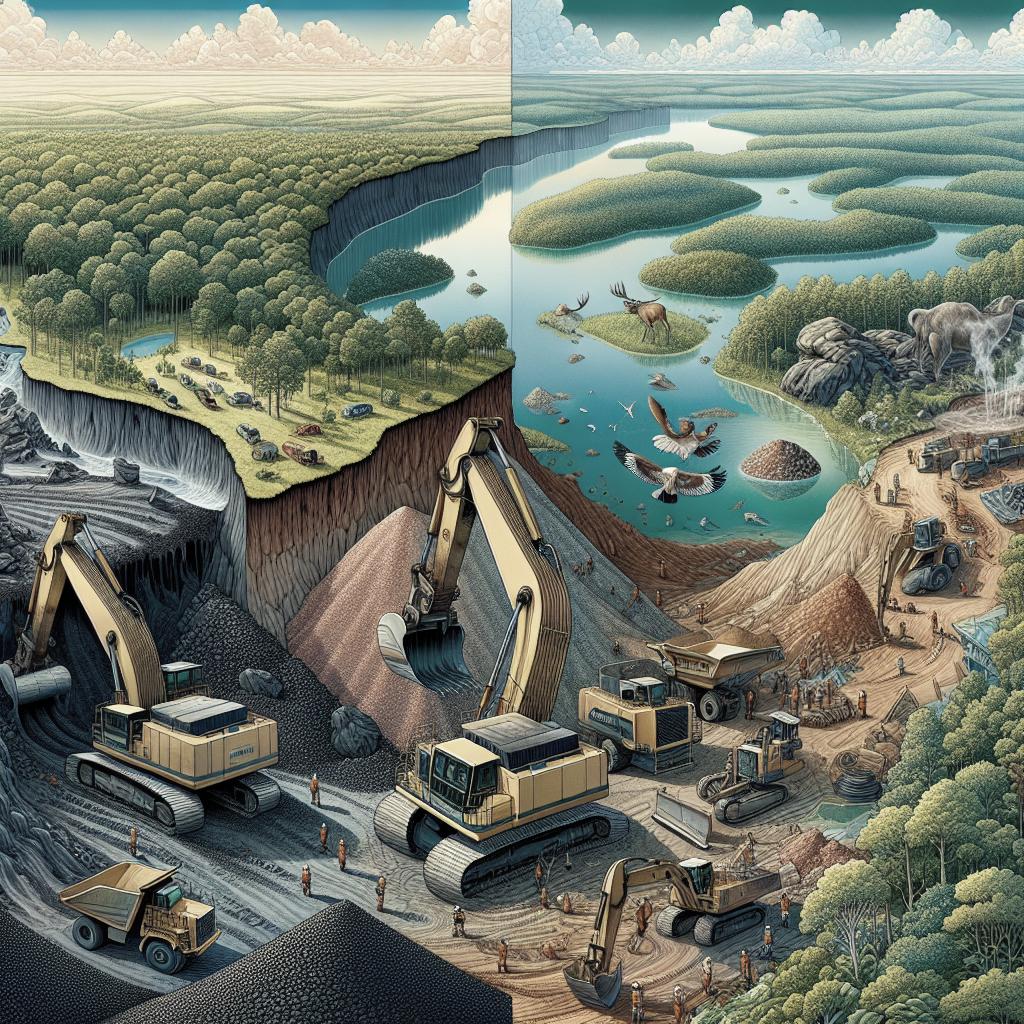

The mining sector is a key driver of economic growth, providing essential raw materials for various industries. Assessing the economic viability of a mining project is crucial for investors, stakeholders, and policymakers to make informed decisions. This detailed guide breaks down the process into manageable steps, guiding you through essential components such as geological assessments, market analysis, regulatory considerations, and financial modeling. By understanding these critical elements, you’ll be better equipped to evaluate whether a mining project is a sound investment or a potential risk.

Rate this article

A thorough feasibility study is the foundation of assessing the economic viability of any mining project. This study should encompass geological surveys, resource estimations, and mine planning. Initially, geological surveys help determine the mineral composition, volume, and quality of the resource. Advanced technologies such as 3D modeling and geostatistics can improve the accuracy of these surveys. Resource estimation follows, involving the classification of mineral resources into measured, indicated, and inferred categories based on the reliability of data. Finally, mine planning outlines the mining method, production schedule, and development phases. This comprehensive approach is pivotal for understanding the project’s potential profitability.

1

Market analysis plays a critical role in determining the economic viability of a mining project. The demand and supply dynamics for the mineral in question need to be carefully assessed. This involves understanding current market prices, future price projections, and potential market shifts. Engaging with industry experts and reviewing historical data can provide invaluable insights. It’s also essential to consider the competitive landscape. Identify major players in the market, their production capacities, and market share. This analysis helps in predicting how new entrants or increased production can affect prices. Ultimately, a clear grasp of market trends will inform investment decisions and risk management strategies.

2

Regulatory considerations are another crucial aspect of evaluating a mining project’s viability. Compliance with local, national, and international laws is non-negotiable. This includes securing mining licenses, environmental permits, and adhering to safety standards. Regulatory hurdles can often lead to project delays or increased costs, so understanding these requirements upfront is vital. Moreover, the socio-economic impact of the project on local communities should not be underestimated. This may involve community engagement, benefit-sharing agreements, and corporate social responsibility initiatives. Neglecting these factors can result in social unrest and legal battles, hampering the project’s success.

3

Financial modeling is the backbone of any economic assessment. This involves constructing detailed financial statements, including cash flow projections, profit and loss statements, and balance sheets. Key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period should be calculated to evaluate the project’s profitability. Sensitivity analysis is equally important. It involves changing key variables such as commodity prices, operational costs, and discount rates to observe their impact on the project’s financial performance. Sensitivity analysis helps in understanding the risk profile and prepares stakeholders for adverse scenarios.

4

Operational considerations cannot be overlooked when assessing a mining project’s viability. This includes evaluating the availability of skilled labor, machinery, and infrastructure. Proximity to power, water, and transportation networks can significantly affect operational costs and project timelines. Additionally, adopting advanced technology can enhance operational efficiency and reduce costs. Moreover, considering the environmental footprint of the operation is crucial. Implementing sustainable practices not only ensures regulatory compliance but also enhances the project’s reputation. Green mining techniques can mitigate environmental impact, ensuring long-term sustainability.

5

Risk management is integral to the assessment process. Identifying potential risks such as geological uncertainties, market volatility, regulatory changes, and operational challenges is essential. Establish a risk management plan that includes risk identification, assessment, and mitigation strategies. Insurance can also play a pivotal role in mitigating financial risks. Policies covering property, liability, and environmental damage can provide a safety net. Additionally, adopting a robust contingency plan ensures that the project can withstand unforeseen challenges.

6

Stakeholder engagement is a critical element in assessing a mining project’s economic viability. Clear communication with investors, regulatory bodies, local communities, and employees fosters trust and collaboration. Regular updates and transparent reporting of the project’s progress can alleviate concerns and build confidence. Moreover, engaging with stakeholders early in the project can help identify potential issues and areas of improvement. This proactive approach can lead to better decision-making and a smoother path to project approval and execution.

7

Technological advancements are revolutionizing the mining industry. Tools such as automation, data analytics, and Internet of Things (IoT) are enhancing operational efficiency and reducing costs. Leveraging these technologies can offer a competitive edge and improve the project’s economic viability. Incorporating renewable energy sources like solar or wind can also reduce operational costs and environmental impact. Investing in innovative technologies not only boosts profitability but also aligns with global trends towards sustainable practices.

Thanks for your feedback

Assessing the economic viability of a mining project involves a multifaceted approach, covering geological assessments, market analysis, regulatory considerations, financial modeling, operational efficiency, risk management, stakeholder engagement, and leveraging technological advancements. Each component plays a crucial role in determining whether the project is a sound investment.

Tell us more

Whether you’re a seasoned investor, a budding entrepreneur, or a stakeholder in the mining industry, understanding these elements can inform your decision-making process. As the mining sector evolves, staying abreast of market trends and technological advancements is essential for success.

More articles on Mining Engineering

Explore more articles that delve into various aspects of mining engineering, from technical innovations to market trends. Staying informed can help you navigate the complexities of the mining industry and make well-rounded decisions.

Are you sure you want to delete your contribution?

Your contributions are valuable to us. If you have any feedback or insights you’d like to share, please consider leaving a comment or contacting us directly.

Are you sure you want to delete your reply?

We appreciate your engagement and want to ensure that your voice is heard. If you have any additional comments or suggestions, feel free to reach out.

Next steps

| Aspect | Description |

|---|---|

| Feasibility Study | Conduct geological surveys, resource estimations, and mine planning. |

| Market Analysis | Assess current prices, future projections, and competitive landscape. |

| Regulatory Compliance | Secure licenses, environmental permits, and engage with communities. |

| Financial Modeling | Create financial statements and perform sensitivity analysis. |

| Operational Efficiency | Evaluate labor, machinery, infrastructure, and environmental impact. |

| Risk Management | Identify risks, establish mitigation strategies, and consider insurance. |

| Stakeholder Engagement | Maintain transparent communication and involve stakeholders early. |

| Technological Advancements | Leverage automation, data analytics, and renewable energy sources. |